Launched two years ago, the fdp Perspective Private Portfolio is a flexible investment solution that easily adapts to the diversified profiles of our investor clients. With the addition of its optionalities, it’s also possible to participate in global investment opportunities in high-potential strategic sectors.

Three optionalities are already available: Environment, Technologies of the Future and Health and Medical Innovations. We are now adding a fourth optionality: Residential Real Estate, a sector that is attracting strong investor interest.

Why residential real estate?

The choice of this new optionality is based on the vitality of this investment sector which, thanks to strong population growth, is expanding rapidly. This optionality also focuses on Canadian residential real estate, across all the major urban areas and reflecting the country’s diverse geography. Analysis of this sector has shown a housing shortage in Canada and a very low vacancy rate for rental properties.

Patrick Ercolano, product manager at fdp, helped set up this optionality. “With an occupancy rate of 98.6% as at March 31, 2023 for Canadian Apartment Properties, a Canadian population that is experiencing the strongest growth of the G7 countries (5.2% from 2016 to 2021), the smallest supply of housing per capita and the highest ratio of house prices to income (1.37 versus 1.35 for the United States and 1.21 for the United Kingdom), Canadian residential real estate is a very attractive option,” he explains.

Other noteworthy characteristics: rental income can adjust to increases in inflation, which provides some protection during more difficult periods, and the residential properties themselves are worth significantly more than the real estate investment trusts (REITs) that represent them.

Strong potential

According to Patrick Ercolano, the residential real estate sector offers great opportunities. “Although past performance does not guarantee future returns, Canadian residential real estate has outperformed Canadian equities by more than 4% over the past 20 years. In the context of strong demographic growth in Canada, where the population has now reached 40 million people compared to around 35 million in 2013, the Canadian residential sector should continue to perform well, taking into account its slightly higher level of volatility.”

Adding this optionality to your Perspective Portfolio, with a weighting to be determined with your advisor, provides attractive income diversification and the opportunity to invest in real estate without owning rental properties yourself, with all the responsibilities that would entail.

Security selection

The securities in this optionality are real estate investment trusts involved in the professional management of residential buildings. They were selected based on a rigorous analysis, which focused in particular on the size of their market capitalization, their debt ratio and their geographic distribution in Canada.

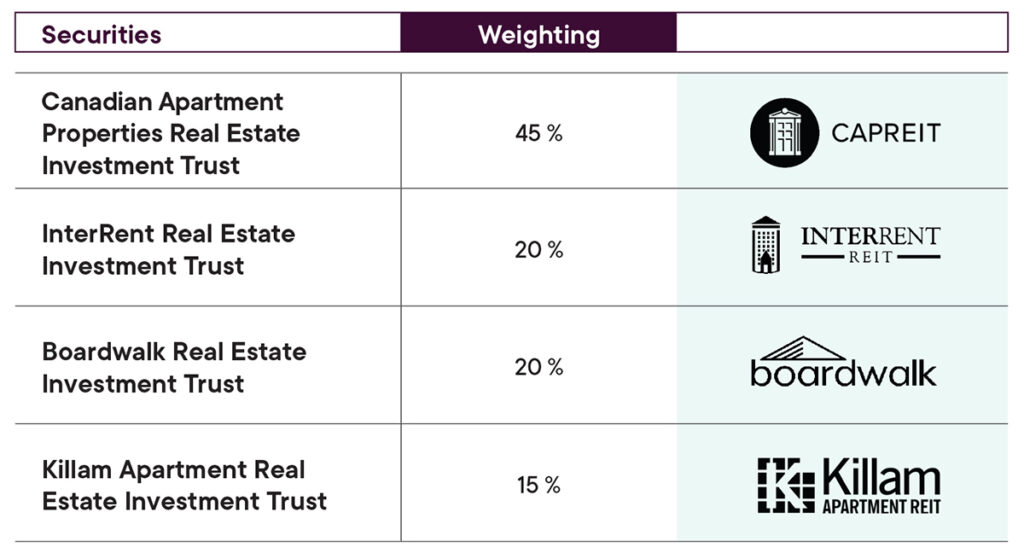

Four securities were selected. Here is their weighting in the optionality:

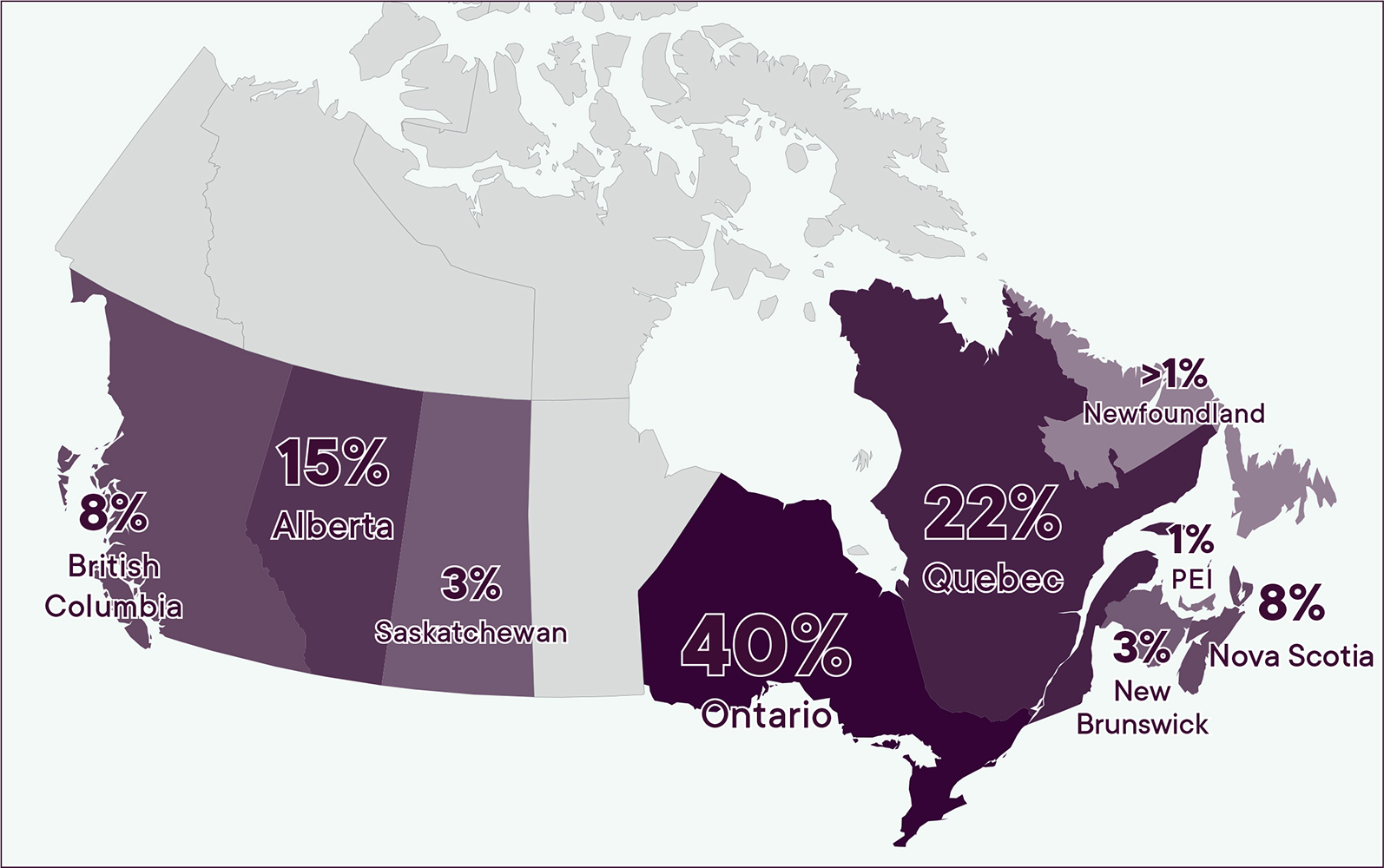

Here is a map indicating the source of revenues of this optionality across Canada.

Finally, note that this optionality and the securities that compose it seek to outperform their benchmark index, the TSX Composite, over the long term, while taking into account the higher level of volatility associated with this sector.

The added value of optionalities

Since the diversification of a portfolio’s sources of return is directly linked to its performance, our Perspective Portfolio optionalities enable you to participate strategically in market developments and trends, without allocating a significant portion of your assets and in keeping with your investor profile.

As Patrick Ercolano explains: “In our Residential Real Estate optionality, we include companies committed to the energy transition such as Killam Properties, which owns six geothermally heated properties, has equipped 24 of its properties with a total 370 electric vehicle chargers, and has also had 18 solar panels installed on its properties to date. Combining this new optionality with our Environment optionality focused on the energy transition enables you to invest in companies that are also pioneers in this sector.”

To learn more about the new Residential Real Estate optionality, speak with your advisor and see how this optionality can fit into your Perspective Portfolio.