Yann Furic

B.B.A., M. Sc., CFA®

Senior Portfolio Manager, Asset Allocation and Alternative Strategies

What moved the markets:

Strong growth on U.S. markets, largely due to results from Nvidia, which is spearheading investment in artificial intelligence.

First policy rate cuts.

|

OVERVIEW OF GLOBAL EQUITY MARKETS |

||||

|

Country |

Index |

Return |

Change |

Year-to-date |

|

Canada |

S&P/TSX |

2.77% |

|

7.58% |

|

United States |

S&P 500 |

4.14% |

|

15.06% |

|

|

Nasdaq |

6.15% |

|

15.60% |

|

International Stock Markets |

EAFE |

3.06% |

|

10.69% |

|

Emerging markets |

|

-0.22% |

|

6.90% |

|

China |

MSCI China |

1.60% |

|

10.36% |

The return shown is the total return which includes the reinvestment of income and capital gains distributions.

Source: Morningstar Direct.

Results – Canadian bonds

The FTSE Canada Universe Bond Index, which includes Canadian government and corporate bonds, has posted a negative return of 1.49% year to date (at May 31, 2024).

(Source: Morningstar Direct)

Our analysis of events

Bank of Canada: first G7 central bank to cut its policy rate

- In the first few days of June, the Bank of Canada made its first rate cut of 25%, and the market is expecting two more this year.

- If the Bank of Canada cuts its policy rate and the Fed doesn’t move, the consequences for the devaluation of the Canadian dollar could be significant. The current baseline scenario calls for one rate cut in the U.S. and two more in Canada by the end of 2024.

- The U.S. Federal Reserve (Fed) kept its key rate unchanged at its June 12 meeting. The first rate cut could now be announced in November, a few days after the U.S. elections, so as not to give a fortuitous advantage to one candidate over another.

- The European Central Bank (ECB) cut its key rate on June 6, and markets are expecting a further reduction towards the end of the year.

- The rate of inflation and how quickly it falls are the two variables with the greatest impact on the markets.

- Canada’s annual inflation rate was 7% for April, down from the previous month and in line with market expectations. In the United States, again in line with market forecasts, the year-on-year inflation rate fell to 3.4% in April, down from 3.5% the previous month.

Some possible scenarios in 2024

- The most positive scenario: a rate cut due solely to a decline in inflation, with no pronounced economic slowdown.

- A strong U.S. economy, requiring fewer rate cuts, could lead to an appreciation of the U.S. dollar against other currencies. This scenario would be negative for the Canadian dollar and would keep inflation higher.

- Most negative scenario: inflation reaccelerates while the economy deteriorates, indicating stagflation.

United States: economy and consumer spending

Historically, consumer spending accounts for around 70% of the U.S. economy. This means that when consumers feel confident, they spend more, fueling economic growth.

In the current economic climate, some companies like Starbucks and McDonald’s have reported that consumers are more reluctant to spend. Other retailers, such as Walmart, have been reporting increased traffic from the affluent family segment for several quarters now.

The question is whether consumers are consciously reducing their purchases, or whether the price of certain goods is now too high, leading to a drop in demand. The price rises of recent years may have reached their maximum threshold for consumers. In light of this development, McDonald’s has announced that its menu will be changed over the course of 2024 to offer less expensive choices to its customers.

World markets and election results

Overall, 2024 will be one of the busiest election years. Financial markets don’t like uncertainty, and they react when election results are different from those expected. The first few days of June were a good illustration of this.

In Mexico, the election of Claudia Sheinbaum, who belongs to the same left-wing party as the incumbent president, was expected. However, the scale of her victory and the possibility of her party gaining a majority in congress, and thus being able to amend the constitution, were not part of the baseline scenario imagined. Investors reacted negatively to the news, with Mexico’s stock market index losing over 10%.

During the same period, in India, Narendra Modi’s majority victory was expected, but he must now form a coalition government since he did not obtain the overwhelming majority expected. The markets fell sharply on this news.

However, these situations do not lead to a permanent negative effect, as evidenced by the surprise election of Donald Trump as president of the United States in 2016, which saw the markets fall on election night, only to reverse course later.

The forthcoming elections in England and France could also have a significant impact on the markets, if the results differ from expectations.

Employment situation

In May, Canada’s unemployment rate was 6.2%, up from the previous month. The number of jobless rose by 26,700, exceeding expectations of 22,500. Annual hourly wage growth, however, remained too high at 5.2%. Canada’s high immigration rate explains why, despite growth in the number of jobs, there has also been an increase in the unemployment rate.

The latest U.S. employment data came as a big surprise, with 272,000 jobs added versus forecasts of 180,000. The unemployment rate is 4.0%. Wage growth remains too high, at 4.1%, up from the previous month.

Economic indicators

Global Purchasing Managers’ Index ![]()

Manufacturing segment indicators continue to hold firm, with nearly half of the 30 countries posting an index reading above 50, signalling an expansion.

Inflation rate ![]()

Overall, inflation is still too high to allow for significant rate cuts.

Benchmark rates in Canada, Europe and the United States ![]()

Interest rates are at a level which, if they remain there for an extended period, will have a major impact on household and business spending when loans come up for renewal. Europe and Canada made their first rate cuts in June, but the next ones could be a long time coming.

Our strategic monitoring

We are monitoring inflation as well as the leading indicators for manufacturing production, the services sector, employment and consumer spending.

Caution and risk management remain our priorities.

Our tactical approach

In May, we maintained the weighting of equities in the tactical allocation strategy since the overall economic outlook has improved.

In the United States, we maintained our position in large cap growth stocks, which react positively to stabilizing interest rates, as well as in stocks with a track record of dividend growth which are more defensive.

We kept a reduced position in small cap stocks, which react well to rate cuts (which have now been postponed to later in the year). We maintained our position in emerging markets, which respond positively to improved global economic conditions.

We remain overweight Japan relative to Europe. The Japanese economic outlook seems brighter to us, but we hedged part of our exposure to the yen, which remains weak.

We continue to favour stocks in developed countries and focus on risk management.

To learn how our funds performed:

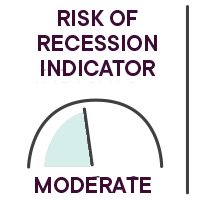

Main risks

- An overly restrictive monetary policy could cause a major recession or other problems, like the U.S. regional bank crisis.

- High interest rates for an extended period would reduce corporate profits and sharply curtail household spending.

- The possibility of an episode of stagflation, i.e. anemic economic growth and high inflation, persists. This situation is negative for stock markets.

- The Israeli-Palestinian conflict could have repercussions throughout the Middle East.

- An escalation of the conflict in Ukraine could spread to other European countries.

- There is also a risk that tensions between China and the United States over Taiwan could worsen.

Senior Manager, Asset Allocation and Alternative Strategies

Data source : Bloomberg

The opinions expressed here and on the next page do not necessarily represent the views of Professionals’ Financial. The information contained herein has been obtained from sources deemed reliable, but we do not guarantee the accuracy of this information, and it may be incomplete. The opinions expressed are based upon our analysis and interpretation of this information and are not to be construed as a recommendation. Please consult your Wealth Management Advisor.