In collaboration with National Bank, we offer you BRIO, a line of credit designed especially for you.

Discover the benefits of BRIO now!

Line of credit

Why use a line of credit?1,2 Because it provides you with working capital that can help you cover the cost of your tuition fees, books, living expenses and various other costs related to your medical studies.

Our line of credit, offered in partnership with National Bank, has many banking benefits including a revolving annual limit based on a budget analysis with your advisor.

Main benefits

- Access to the funds at any time.

- Competitive interest rate.

- No repayment of principal or interest during your full-time studies or your residency.3

Want to talk about it?

The personalized assistance offered by our advisors helps you to prioritize your expenses and manage your debt responsibly. Don’t hesitate to contact us for more details!

1 Subject to credit approval by National Bank. Certain conditions apply. A guarantor (surety) who meets National Bank’s criteria may be required. The annual amount is based on your personal budgetary requirements.2 When a client account is opened at Professionals’ Financial (minimum balance of $25).3 The line of credit bears interest as of the date it is used. The minimum monthly payment is the monthly interest amount, which may be deferred (added to the principal of the line of credit) for up to 24 months following the end of full-time studies. Prime rate means the annual variable interest rate published by National Bank from time to time and used to establish the interest rate on Canadian dollar demand loans granted by National Bank. To know the prime rate, visit nbc.ca.

Life insurance

To enable you to protect your loved ones, the line of credit offer is doubled to include free life insurance offered by Professionals’ Financial through Sogemec Assurances, for the entire duration of your full-time medical studies.1,2

Main benefits

- No fees until the end of your clerkship.

- You appoint the beneficiary of your choice.

- Personalized coaching service offered by Sogemec Assurances.

- The coverage can be maintained at the end of your clerkship subject to payments of an attractive premium negotiated for you.

- The coverage will come into effect at the same time as your line of credit.

- The insured amount of $100,000 will be paid to your beneficiary, regardless of the outstanding balance on your line of credit.

1 The mandatory life insurance is free. The cost of the life insurance premium will be paid entirely by Professionals’ Financial until the end of your clerkship, after which the student may decide to cancel the coverage or maintain it and assume the cost. The coverage amount is $100,000, but the student is free to increase this coverage during their studies by paying an additional premium.2 The free life insurance is offered exclusively to students who take out a line of credit, which is subject to credit approval by National Bank of Canada.

Other benefits

By signing up for a BRIO line of credit, you’ll also have access to other banking benefits:

- Personalized assistance from our advisors to help you prioritize your expenses and manage your debt responsibly.

- A CDN$ bank account1 with no monthly service fees on transactions included in the offer.

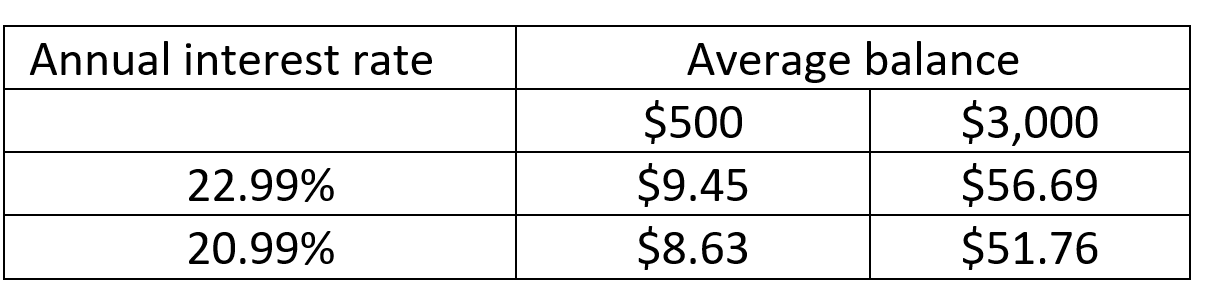

- A Platinum Mastercard®,* with no annual fee for the first two years.† After that period, the regular annual fee of $89 will apply. The regular annual interest rates on the card are 20.99% for purchases and 22.99% for balance transfers and cash advances.

- Free access to telephone and Internet banking services.

- Several types of transactions in an unlimited number.

- First order of 100 personalized cheques included (shipping and taxes extra).

1 Bank account with chequing privileges. Certain services, such as paper statements, are not included.® Mastercard is a registered trademark of Mastercard International Inc. National Bank of Canada is an authorized user.2 Subject to credit approval by National Bank. Certain conditions apply.* Subject to credit approval by National Bank of Canada. Certain conditions apply. Grace period: No interest will be charged on purchases made during the month provided the client pays his balance in full within twenty-one (21) days of the date of the statement. This grace period does not apply to cash advances or balance transfers. Your minimum payment will correspond to 3% of your account balance plus any amount already due or $10, whichever amount is higher. If your account balance is lower than $10, you must pay the entire balance. If you exceed your credit limit, the amount of the minimum payment will be the higher of the following amounts: (a) 3% of the account balance or (b) the amount of the overlimit. Account statement: A statement is sent monthly. Examples of credit charges calculated for a period of thirty (30) days:

† Two years after the card is issued, the annual fee in effect at that time will be billed automatically and will appear on your monthly statement. Offer not renewable.