For an analysis of your situation, get in touch with one of our advisors

1 844 854-6055Toll free

Contact us

My insurances

Insurance in retirement?

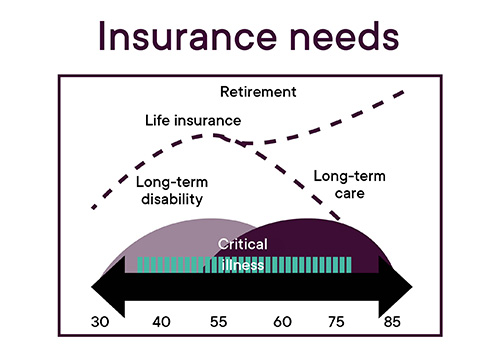

You’re in transition and about to retire, if you haven’t already done so. Your insurance needs are not the same as they were when you were starting your career or in practice.

Identify your needs

You now have to think about protecting your assets and, of course, obtaining coverage for long-term care, prescription drugs, etc.

Understand the risks

The key is to make sure you have sufficient coverage, from both a personal and a professional standpoint, in terms of life insurance, disability insurance, prescription drug insurance, and property insurance.

Risk, frequency and seriousness

When identifying your needs, the types of risks are a decisive factor. Insurers assess the benefits required to maintain your standard of living and that of your dependents or your partners, as well as the benefits required to pay off your creditors.

| Risk | Frequency | Seriousness |

|---|---|---|

| Home fire | Low | High |

| Prescription drug claim | High | Low |

| Sick day | High | Low |

| Long-term disability | ||

|

Low | High |

|

High | Low |

| Death | ||

|

Low | High |

|

Low | High |

|

High | Low |

Changing needs

At this stage you have to make certain decisions:

- Reduce, increase or cancel your insurance coverage?

- Right to convert your term insurance to permanent.

- Changes to consider, such as a change of beneficiary.

Last survivor life insurance?

This type of insurance can cover taxes, if your estate includes real property or registered investments, or if there are any other tax bills to pay upon death. It can also serve to rebuild an estate.

Do you still need disability insurance?

If have reached retirement age, it may be advisable to keep this insurance, on certain conditions.

- If there is a gradual decrease in hours worked, adjust your coverage accordingly.

- After age 65: 24-month benefit period.

- Generally, you can keep your insurance until age 70 if you are still working full time.

- Some contracts offer benefits after age 70, on certain conditions.

If you are fully retired, you no longer need this type of insurance, which covers potential loss of income and office overhead expenses.

Private prescription drug insurance

Since January 1, 1997, the Act respecting prescription drug insurance has obliged all Quebec residents to have private prescription drug insurance.

Exceptions:

- You have a group insurance plan (through your employer, your federation or your association).

- Your spouse has access to a group plan.

- You are age 65 or older.

The public plan

At age 65, you are automatically enrolled in the public plan, so there’s no reason to keep your private prescription drug insurance, except in rare cases, such as costly drugs that are not covered by the public plan.

Critical illness insurance

This insurance pays a non-taxable lump-sum benefit of $25,000 to $1 million. Generally, this amount is paid if you survive 30 days after the diagnosis of a critical illness covered under your contract.

For most companies, 60 is the maximum age for purchasing this insurance. If you have a return of premium rider on a contract that is already in force, in most cases it is advantageous to maintain the contract.

Your recovery

This benefit enables you to:

- improve your quality of life

- reduce financial stress and strain

- focus on your recovery

.

Your long-term care

If you don’t want to be a burden on your family if you lose your autonomy, and you want to maintain some independence despite some difficulties, long-term care insurance may be a good solution.

Routine activities

After a waiting period, you will receive a monthly benefit:

- If you cannot perform two of the following six routine activities:

- Wash yourself.

- Clothe yourself.

- Use the bathroom.

- Be continent.

- Move about.

- Feed yourself.

- If you have a cognitive deficiency that jeopardizes your health and safety as well as the health and safety of others.

A life annuity

It is possible to transfer the capital from your investments to an insurance company, which will then pay you a monthly annuity for life.

Is it for you?

A life annuity can be an attractive option for someone who has surplus capital (more than enough assets for retirement). It can also replace part of your non-registered fixed-income securities.

- Advantages

The capital is not subject to market fluctuations. - Disadvantages

The capital is no longer available, since the purchase of an annuity is irreversible.

You may incur a financial loss if you die prematurely.

Adding a protection clause reduces the monthly payment.

To learn whether an annuity is the right solution for you, speak about it with your advisor.

Risk management

Your insurance portfolio should be reviewed regularly. It is an integral part of a sound personal financial plan.

When to buy?

These major life events are generally a good time to consider insurance:

- Birth of a child or grandchildren,

- Marriage or divorce,

- Death of a parent or a spouse,

- Children leaving home to study or to start a family,

- Purchase of a home or a cottage,

- New job or business start-up.

These are opportunities to review your insurance needs and, above all, to make sure your needs are fully covered.

Be informed

Make your life easier

fdp Private Wealth Management gives you access to all the resources you need to help you make the best choices. In collaboration with our affiliated companies in the insurance field, our professionals have the necessary expertise to guide you and assist you.

Professionals you can trust

For more detailed answers and a thorough analysis of your situation, place your trust in one of our advisors.