What moved the markets in May

- Very volatile month for the North American stock markets, which ended May where they started.

- Uncertainty about the extent of central bank rate hikes.

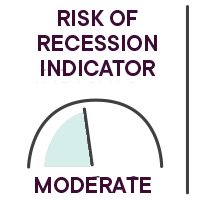

- Risk of stagflation and recession still present.

- Precarious supply chains.

|

OVERVIEW OF GLOBAL EQUITY MARKETSS |

||||

|

Country |

Index |

Return |

Change |

Year-to-date return |

|

Canada |

S&P/TSX |

+0.06% |

|

-1.25% |

|

United States |

S&P 500 |

-1.25% |

|

-12.87% |

|

|

Nasdaq |

-3.33% |

|

-22.62% |

|

International stock markets |

EAFE |

-0.57% |

|

-11.10% |

|

Emerging markets |

|

-0.98% |

|

-11.83% |

|

China |

MSCI China |

-0.27% |

|

-16.82% |

* All percentages are in Canadian dollars. Source: Morningstar Direct.

Key events

Policy rate hikes continue

Central banks made further rate hikes, in keeping with their earlier announcements.

- On June 1, the Bank of Canada raised its policy rate by 0.5%.

- The Fed raised its key rate by 0.5% on May 4 and should increase it by 0.5% in June.

Comments from the Bank of Canada on June 1 and 2 suggest that the increases could be bigger than expected. The target rate could reach 3.25% at the end of 2022. Currently, the policy rate is 1.50%.

The Fed trims its balance sheet

The reduction of the Fed’s balance sheet will begin in June at a slower-than-expected pace, then get up to speed three months later, in August. This reduction program means that the proceeds from certain maturing bonds as well as the coupon payments on bonds held by the central bank will no longer be reinvested, which will have the same effect as an increase in interest rates. Both the Bank of Canada and the Fed are trying by all possible means to quickly reduce inflation.

And what about economic growth?

If the objective is to maintain economic growth while limiting inflation, it will be difficult for central banks to raise rates as quickly as expected without creating a recession. The risk of stagflation is significant if economic growth slows sharply without a concomitant drop in inflation.

The effect of rate increases is greater on the demand for goods and services, but less on the price of food and energy.

Market reaction

Bond and equity markets continue to react to messages from central banks and remain fearful that they are being too aggressive in their combined action of raising rates and shrinking their balance sheets. Markets will likely stabilize once investors have a better idea of the magnitude of the rate hikes required, which will result in a revaluation of stock and bond prices. During this time of uncertainty, markets remain volatile. The situation is particularly difficult for technology stocks, especially those of companies that are not profitable.

Impact of the geopolitical situation

In China, the government’s handling of the latest wave of COVID-19 with its zero-tolerance strategy is hurting the restoration of supply chains.

Moreover, the invasion of Ukraine by Russia and the impact of this war on commodity prices remain a major concern for the markets.

Employment situation

In the United States, job creation was stronger than forecast, with 390,000 new jobs versus expectations of 318,000. The fact that the labour force participation rate has increased and that people of working age are actively re-entering the market is a positive. The unemployment rate remained stable at 3.6%, indicating a good general employment situation.

In Canada, 39,800 jobs were created, beating the 27,500 forecast. It was mainly full-time jobs that saw a strong increase, with 135,400 compared to expectations of 22,600, while 95,800 part-time jobs were lost, when forecasts were for the creation of 9,900 part-time positions. The unemployment rate dropped to 5.1%.

Results – Canadian bonds

The FTSE Canada Universe Bond Index posted a negative return of 10.3% since the beginning of the year. (Source : Morningstar Direct)

Performance of our funds

View the returns

Our strategic monitoring

Since the beginning of the year, our internal and external managers have taken a number of steps to reduce portfolio risk.

To protect our clients’ portfolios, we have kept a high weighting of Canadian stocks, which react positively in an inflationary environment where demand for metals and energy is strong.

Our managers invest in quality, less volatile stocks. They favour companies that are able to pass on cost increases, which limits the impact of inflationary pressures on profit margins.

As for fixed income, a number of strategies have been adopted to limit the negative effect of rate hikes.

Main risks

- The possibility of an episode of stagflation, a state of anemic economic growth and high inflation that is negative for stock markets, remains.

- An overly restrictive monetary policy could cause a major economic slowdown or even a recession.

- A major recession could occur in Europe if Germany decides to cut off all Russian gas imports.

Fundamental indicators

Some economic indicators that we continued to follow in May.

Benchmark rates in Canada, Europe and the United States ![]()

Rate hikes continue and central banks are acting aggressively to reduce inflation.

Global Purchasing Managers’ Index ![]()

The index remains above 50, which indicates an economic expansion. China’s number is below 50 and thus in contraction territory and this negative trend continued in May.

Inflation rate ![]()

With the inflation rate far exceeding central banks’ targets, they continue to raise their policy rates. The crisis in Ukraine is also increasing the costs of the energy and food components, on which rate hikes have a limited effect. China’s zero COVID-19 strategy continues to disrupt supply chains, thereby increasing inflationary pressures.

|

|

| François Landry, CFA Vice-President and Chief Investment Officer |

Yann Furic, B.B.A., M.Sc., CFA Senior Manager, Asset Allocation and Alternative Strategies |

Data source: Bloomberg

The opinions expressed here and on the next page do not necessarily represent the views of Professionals’ Financial. The information contained herein has been obtained from sources deemed reliable, but we do not guarantee the accuracy of this information, and it may be incomplete. The opinions expressed are based upon our analysis and interpretation of this information and are not to be construed as a recommendation. Please consult your Wealth Management Advisor.