Yann Furic

B.B.A., M. Sc., CFA®

Senior Portfolio Manager, Asset Allocation and Alternative Strategies

What moved the markets:

Significant rise in stock markets, mainly outside the U.S.

Global economic slowdown.

|

OVERVIEW OF GLOBAL EQUITY MARKETS |

||||

|

Country |

Index |

Return |

Change |

Year-to-date |

|

Canada |

S&P/TSX |

5.87% |

|

12.28% |

|

United States |

S&P 500 |

2.19% |

|

22.26% |

|

|

Nasdaq |

0.22% |

|

23.32% |

|

International Stock Markets |

EAFE |

3.92% |

|

13.60% |

|

Emerging markets |

|

1.26% |

|

12.94% |

|

China |

MSCI China |

-0.38% |

|

8.27% |

The return shown is the total return which includes the reinvestment of income and capital gains distributions.

Source: Morningstar Direct.

Results – Canadian bonds

The FTSE Canada Universe Bond Index, which includes Canadian government and corporate bonds, has posted a positive return of 1.50% year to date (at July 31, 2024).

(Source: Morningstar Direct)

Our analysis of events

Bank of Canada cuts rates again: will the Fed follow soon?

- On July 24, the Bank of Canada made a second rate cut of 25%, bringing the policy rate to 4.50% following the June cut. The market is anticipating two or three more cuts this year.

- If the Bank of Canada continues to lower its key rate without the Fed following suit, the Canadian dollar could experience a major devaluation, which would have a negative impact on the Canadian economy.

- The U.S. Federal Reserve (Fed) kept its key rate within a range of 5.25% to 5.50% at its July 31 meeting. The latest employment data released differed significantly from expectations and seem to support the strong probability of a first rate cut in September. The consensus scenario is now four rate cuts by the end of the year in the U.S.

- In Japan, the sudden rise in interest rates, combined with fears of a U.S. recession following the release of employment data, strongly shook the market in the first few days of August.

- The two variables with the greatest impact on the markets continue to be the rate of inflation and how quickly it falls.

In Canada, the annual inflation rate was 2.7% in June, down from the previous month but below market expectations. In the United States, the annual inflation rate eased to 2.9% in July, down slightly from the previous month, which was viewed positively by the markets.

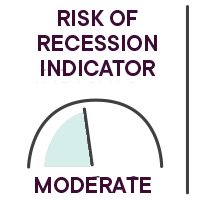

Scenarios still possible between now and the end of 2024

- The most positive scenario would be a rate cut due solely to a decline in inflation, with no pronounced economic slowdown.

- A strong U.S. economy, requiring fewer rate cuts, could cause the U.S. dollar to appreciate against other currencies. This would be negative for the Canadian dollar, and would keep inflation higher in Canada.

- The final hypothesis remains reaccelerating inflation with a worsening economy, which would indicate stagflation. This would be the most negative scenario.

Employment situation

In Canada, the unemployment rate remained stable at 6.4% in July compared with the previous month. 2,800 jobs were lost, when forecasts called for the addition of 25,000 jobs. Hourly wage growth remained too high at 5.2% on an annual basis, down from the previous month but still above expectations. On a positive note, 61,600 full-time jobs were created, while 64,400 part-time jobs were lost.

The latest U.S. employment data showed a significant drop, with 114,000 jobs added versus expectations of 175,000. The unemployment rate rose to 4.3%. Job creation numbers for recent months have been revised downwards, leading to an increase in this rate. Wage growth was still too high at 3.6%, but down from last month.

Economic indicators

Global Purchasing Managers’ Index ![]()

Indicators for the manufacturing segment deteriorated, with less than half of the 30 countries posting an index reading above 50 (expansion). The services segment, however, remains strong, and even improved in the case of France and Japan, two countries where the manufacturing component is contracting.

Inflation rate ![]()

Overall, inflation remains too high to allow for significant rate cuts, but it continues to move in the right direction.

Benchmark rates in Canada, Europe and the United States ![]()

Interest rates have been high for some time now. Upcoming mortgage and corporate loan renewals could force consumers and businesses to reduce their spending now, in anticipation of rates that are higher than initially expected.

As reported in the summaries of discussions at the last meeting of its Governing Council, the Bank of Canada is acutely aware of the problem of loans up for renewal in 2025 and 2026.

Our strategic monitoring

We are monitoring inflation and consumer spending, as well as leading indicators for manufacturing production, the services sector and employment.

Caution and risk management remain our priorities.

Our tactical approach

In July, we maintained the weighting of equities in the tactical allocation strategy, with the economic outlook and market indicators still dictating an overweight position, albeit less pronounced than a few months ago.

In the United States, we maintained our position in large cap growth stocks, which react positively to stabilizing interest rates, as well as in stocks with a track record of dividend growth which are more defensive.

We kept our position in small cap stocks, which react well to rate cuts, and increased our position in emerging markets, mainly due to economic growth in countries other than China.

In August, we reduced our positions in Japan and Europe. However, we maintained our overweight in Japan, since the Japanese economic outlook seems even brighter.

We increased our weighting in emerging markets and Canadian equities.

In the fixed-income component, we increased the weighting of corporate bonds and reduced that of high-yield bonds. Last month, we took a position in government issues in emerging economies that are showing attractive economic growth.

We continue to favour stocks in developed countries and focus on risk management.

To learn how our funds performed:

Main risks

- An overly restrictive monetary policy could cause a major recession or other problems, like the U.S. regional bank crisis.

- A monetary policy risk is emerging, as witness Japan’s rate hike, which had a marked effect on all the world’s markets.

- High interest rates for an extended period would reduce corporate profits and sharply curtail household spending.

- The possibility of an episode of stagflation, i.e. anemic economic growth and high inflation, persists. This situation is negative for stock markets.

- The Israeli-Palestinian conflict could have repercussions throughout the Middle East.

- An escalation of the conflict in Ukraine could spread to other European countries.

- There is also a risk of worsening tensions between China and the United States over Taiwan.

Senior Manager, Asset Allocation and Alternative Strategies

Data source : Bloomberg

The opinions expressed here and on the next page do not necessarily represent the views of Professionals’ Financial. The information contained herein has been obtained from sources deemed reliable, but we do not guarantee the accuracy of this information, and it may be incomplete. The opinions expressed are based upon our analysis and interpretation of this information and are not to be construed as a recommendation. Please consult your Wealth Management Advisor.