Despite the climate of uncertainty, stocks and bonds once again showed great resiliency in the first half of the year.

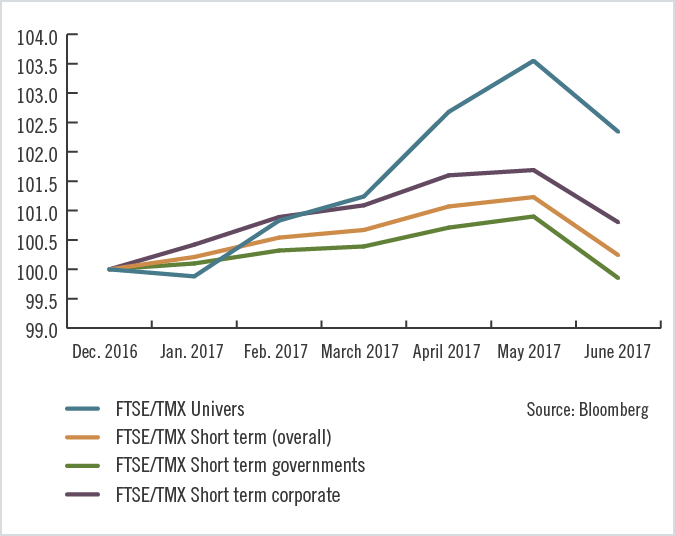

Fixed-income securities

Benefiting from an unanticipated decline in yields, bonds generally performed well, with the S&P FTSE TMX Universe Index advancing more than expected. Corporate bonds contributed the most to the return of this asset class.

Factors behind the surprising decrease in bond yields include lower inflation expectations due among other things to the Trump administration’s difficulties in implementing its pro-growth measures, and the publication of disappointing U.S. economic data. The yield curve flattened during the first six months of the year and long-term yields are not pricing in a pickup in economic growth.

Current conditions prompt us to take a cautious approach to bonds held in our portfolios. We also intend to mitigate the very low nominal yields in industrialized countries through sound geographic diversification. Interest rates changed direction late in the first half in line with central bank guidance. It is increasingly clear that the emergency measures put in place since 2008 will be gradually withdrawn.

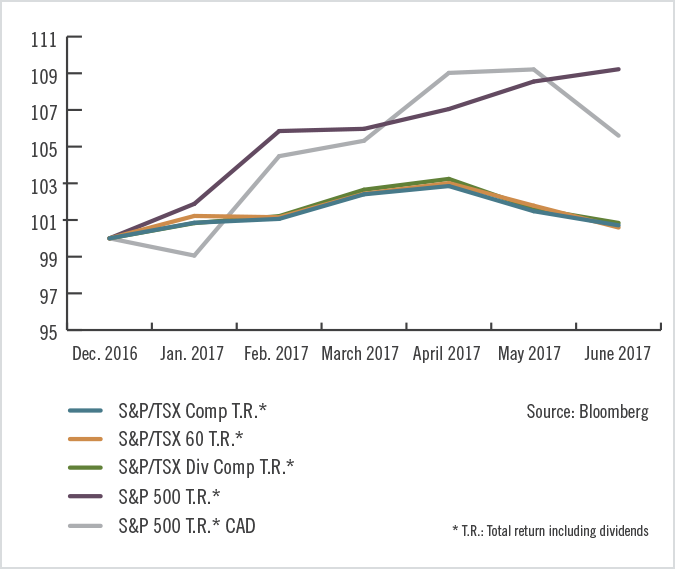

Canadian equities

The Canadian stock market performed weakly in the first half, despite substantial economic growth and the fact that Canadian companies reported an increase in earnings per share of more than 30% in the first quarter. With the decline in the price of oil, the overvaluation of the real estate sector and the renegotiation of NAFTA, investors seemed to show little interest in Canadian equities.

We believe the Canadian market could rebound by year end, but the longer term outlook is more uncertain, because of its high concentration in the oil and bank sectors, whose growth will be more constrained. In light of these observations, we plan to continue our rather defensive strategy for Canadian equities by focusing on more liquid stocks and on large caps with sustained growth and solid balance sheets.

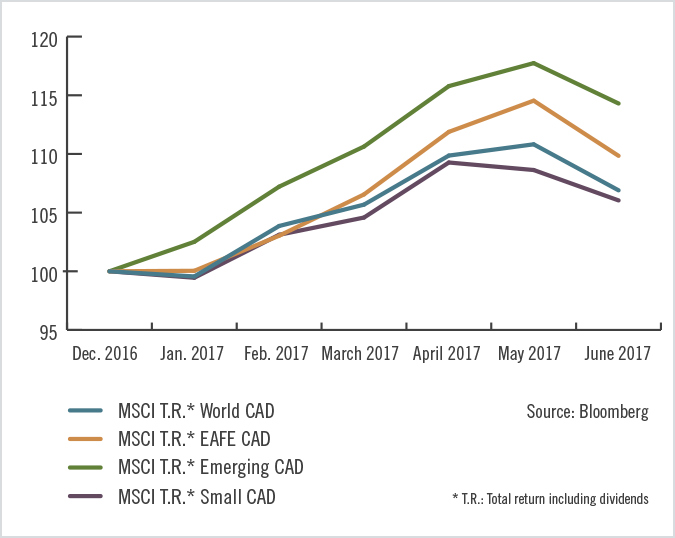

Global equities (including U.S. equities)

Global equities performed better in the first half, particularly European and emerging market stocks. Led by the technology sector, the U.S. stock market delivered a high return, despite investors’ belief that U.S. stocks are expensive.

In our view, American equities should nevertheless not be neglected because of eventual tax cuts which should stimulate U.S. economic growth. We also believe that European stocks offer some good opportunities, considering the earnings being reported and the political environment in the euro zone, which is becoming less risky.

Our portfolios currently hold stocks from different regions of the world, providing us with excellent diversification. We plan to continue to take advantage of the appetite for foreign equities as long as opportunities present themselves.

To view the recent evolution of the different markets, consult our Numbers and charts section.

Here are some interesting reads: